Overview

The country became an oil producing country on 20 December 2019 when the floating production, storage and offloading (FPSO) vessel Liza Destiny began producing oil from offshore Guyana. Oil production figures from Liza phase 1 which reached 27.198 and 20.230 million of barrels in 2020 and 2021 respectively.16 The Guyana government published revenues from oil sales received in the Natural Resource Fund (NRF) and which amounted to GYD 262,041 million and GYD 74,478 million in the 2022 and the first quarter of 2023 respectively. The daily production of oil from 9 January 2020 to April 2023 is published systematically by the Ministry of Natural Resources.

Geological Overview

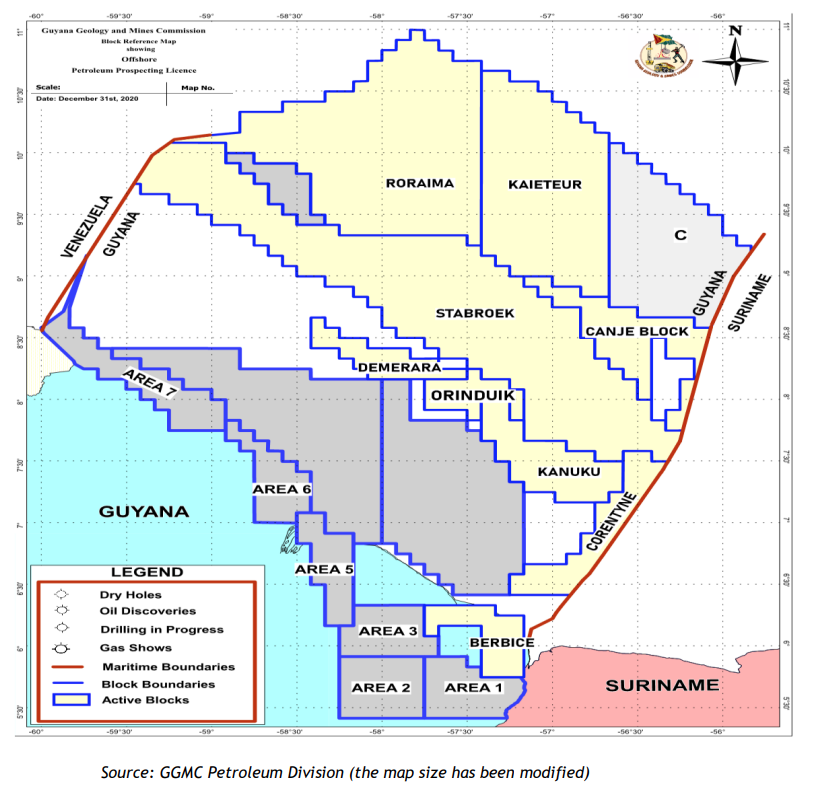

Guyana is divided into two petroleum basins: the Guyana Basin which comprises both onshore and offshore blocks and the Takutu Basin.

- Guyana Basin is a cretaceous sedimentary basin geographically situated along the north-east coast of South America extending across the maritime areas of Guyana, Suriname, and French Guyana. The Guyana Basin’s surface is approximately 120,000 km2 and can be divided into two blocks:

- Coastal onshore Basin:18 Since 1916, 13 wells have been drilled in this part of the Basin. The eastern part of the basin has the thicker sediments reaching at a depth of nearly 2,500 m;

- Offshore Basin:19 from the nearshore to around 80 miles to the north, the seabed is generally on the continental shelf. Then it moves to the slope and as one gets further it reaches the deep-water area. From the northwest to the north-eastern area depths can be from 1,000 feet to more than 10,000 feet; and

- Takutu Basin20 is situated in the south-west of Guyana and measures approximately 280 km long from Boa Vista, Brazil to the Essequibo River of Guyana and has an area of 9,800 km2 .

Petroleum exploration history in Guyana

The first substantial effort to locate petroleum started when exploration deposits were drilled in the Waini area of the country’s northwest District. However, one of these deposits recorded gas and pitch. In 1926, a deposit was drilled on the west coast of Berbice at the Bath Sugar Estate and the gas recovered there was used for domestic purposes.

Multiple reports of oil seepages in Guyana (then British Guiana) piqued the interest of the Trinidad Leaseholds Co. Ltd., and the first oil prospecting license was applied for and subsequently granted. In 1939, seismic exploration over the eastern part of the Atlantic Coast spurred the company to drill a deep test well, known as Rosehall No.1 or (BG-1), at a site near New Amsterdam.

In 1958, a regional survey of the shelf was conducted by Standard Oil of California, but no wells were drilled.

In 1965, the giant Tambaredjo Field was discovered in onshore Suriname. Exploration licenses were granted to Shell and Conoco for an onshore and offshore block. Shell and Conoco assigned 50% of their rights to Tenneco. Shell conducted seismic surveys in 1965 and started a drilling campaign in 1966. They sank six wells to obtain stratigraphic information and test the heavy oil along the fringe of the Guyana Basin. In 1967, the Conco/Tenneco partnership sank two offshore wells.

Five holes were drilled in 1974, four by Shell and one by Deminex. Indeed, Shell drilled Mahaica 1 which terminated at 8,104 feet in Paleocene sediments, Berbice 2 which terminated at 10,049 feet in Upper Oligeance sediments, Abary 1 in the deepest part of the offshore basin close to a target seismic horizon and Mahaica 2 located close to the shore than Mahaica 1. No hydrocarbon shows were found.

Home Oil drilled Karanambo27 -1 well in 1982. They sank the Lethem 1 and Karanambo 1 wells in the Takutu Basin. Tests on corresponding samples found contained less than 0.5% hydrogen sulphide. The other well drilled in the Takutu during that same period is Lethem-1.

In 1991, Mobil Corporation acquired rights for offshore exploration and started a geological and geo-chemical exploration programme. Lasmo/BHP failed to raise funds for their proposed drill programme which was based on the results of their offshore seismic survey completed in 1989 and they withdrew in 1991. Likewise, the Petrel/GEL partnership could not attract funding for additional exploration, so they withdrew in 1992. Mobil could not attract partners either to jointly drill a well and they withdrew in 1994.

Total joined the partnership of Petrel Petroleum Corporation and Guyana Exploration Ltd in 1989. The group sank the Arapaima 1 offshore well between 1991 and 1992 to test the upper and lower Cretaceous calcareous shale reef formations along the edge of the Guyana offshore basin. A good reservoir quality was found in sandstone, but the calcareous formations had low porosities. Gas shows were found in certain horizons. This well was abandoned at 11,090 feet.

After ten (10) years of the discovery of oil in Karanambo 1 well in fractured Apoteri volcnics of the Takutu Basin by Home Oil, Guyana Hunt Oil drilled the Turantsink 1 well 25 miles south of Karanambo 1 at the northern edge of the Takutu basin in December 1992. Oil shows were found in several sections. The well was abandoned in 1993 at a depth of 11,600 feet in Apoteri volcanics. Hunt Oil relinquished their Takutu concession at the end of 1993.

Between 1992 and 1994, GGMC participated as an associate member in the South American Mapping Project (SAMMP) which was sponsored by six major oil and mining companies (AMOCO, BHP, CONOCO, Exxon, JNOC and UNOCAL) to gather aeromagnetic and marine magnetic data on the South American continent and its offshore continental margin to compile, display and prepare a digital dataset and produce a comprehensive report.

Guyana and Suriname finally resolved the maritime dispute through the arbitration of the UN Tribunal of the Law of the Sea, luring back international Exploration and Production companies, such as CGX Energy Inc, Repsol and Exxon Mobil Corporation, which together with partners CNOOC Ltd and Hess Corporation signed PSC Stabroek with the Guyanese government. Meanwhile, a cohort of wildcatters who had remarkable success off West Africa came to the basin believing the petroleum systems in Guyana were supposed to be the mirror images of those in West Africa, these including Tullow Oil plc, Kosmos Energy Ltd and Eco Atlantic Oil & Gas Ltd.

ExxonMobil initiated oil and gas exploration activities in Guyana, collecting and evaluating substantial 3D seismic data that led to the company safely drilling its first exploration well in 2015 named Liza-1. The Liza discovery was announced in May 2015

Since the discovery of the giant Liza field in 2015, ExxonMobil has made a total of fifteen (15) discoveries with just two dry holes at the prolific Stabroek Block where estimated resources exceed 6 billion barrels of oil equivalent31 . Esso Exploration and Production Guyana Limited signed a Production Sharing Agreement (PSA) in 2016 and paid the Guyanese Government a signature bonus of US$18 million32 into a bank account owned by the Government of Guyana held at the Bank of Guyana.

Seven (7) discoveries in Guyana’ offshore basin were made: Five (5) from ExxonMobil and two (2) from Tullow Oil in the Orinduik block. Guyana became an oil producing country on 20 December 2019.

The Carapa-1 discovery was announced. Carapa is Repsol’s first discovery in the Kanuku Block. The well encountered approximately four metres of net oil pay. It was drilled to a total depth of 3,290 metres in 68 metres of water. 34 Further, the Minister of Natural Resources announced Guyana’s 18th Offshore Oil Discovery at the Redtail-1 exploration well in September 2020. This added to the estimated recoverable resource of more than eight (8) billion oil- equivalent barrels on the Stabroek Block.

The Ministry of Natural Resources published the production oil lifted from Liza Destiny between February 2020 and July 2021 as set out in Section 3.12.1 of the Country Report FY 2020

The main Oil & Gas exploration players in Guyana

The main operators in the oil and gas sector in Guyana.

Prospecting licenses and blocks in the oil and gas sector

Legal and Institutional Framework

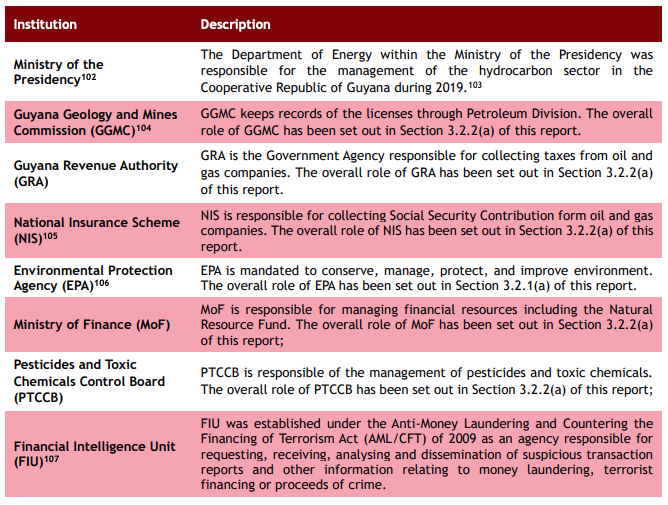

Institutional Framework

The main Government Agencies involved in the Oil and Gas sector are as follows:

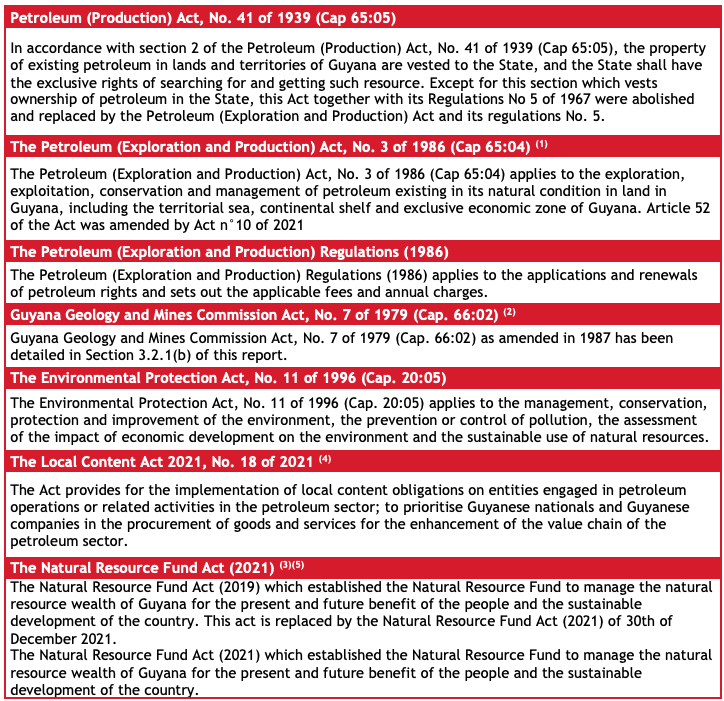

Legal Framework

The Guyanese upstream oil and gas sector is regulated by the following main laws and regulations:

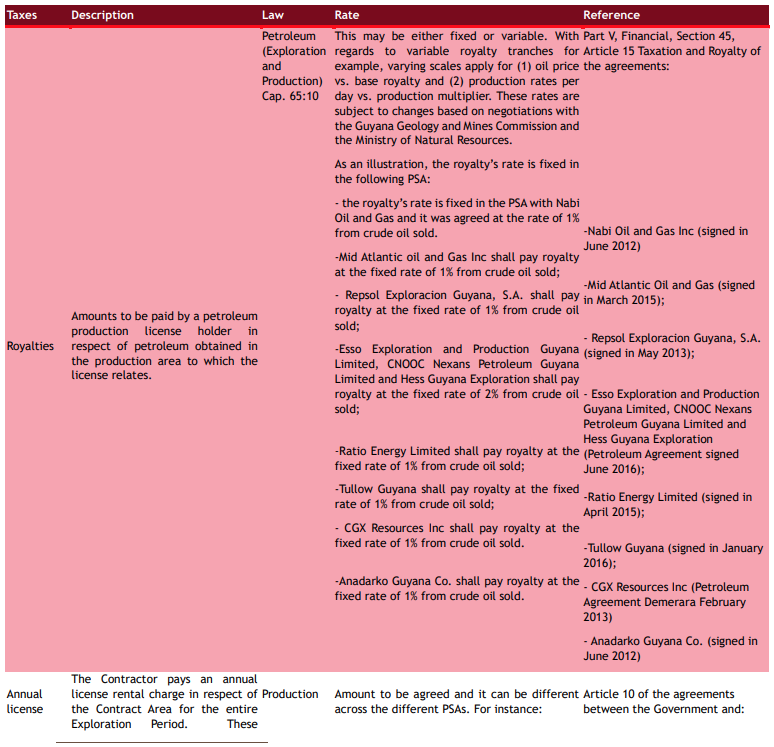

Fiscal Regime

Common Tax Regime

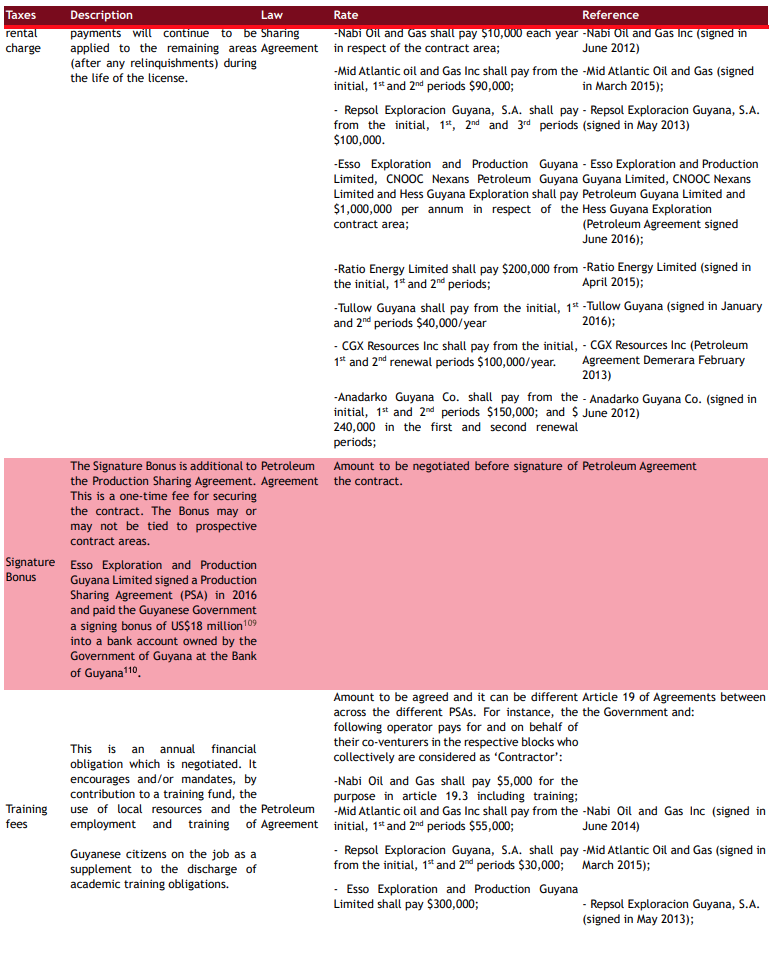

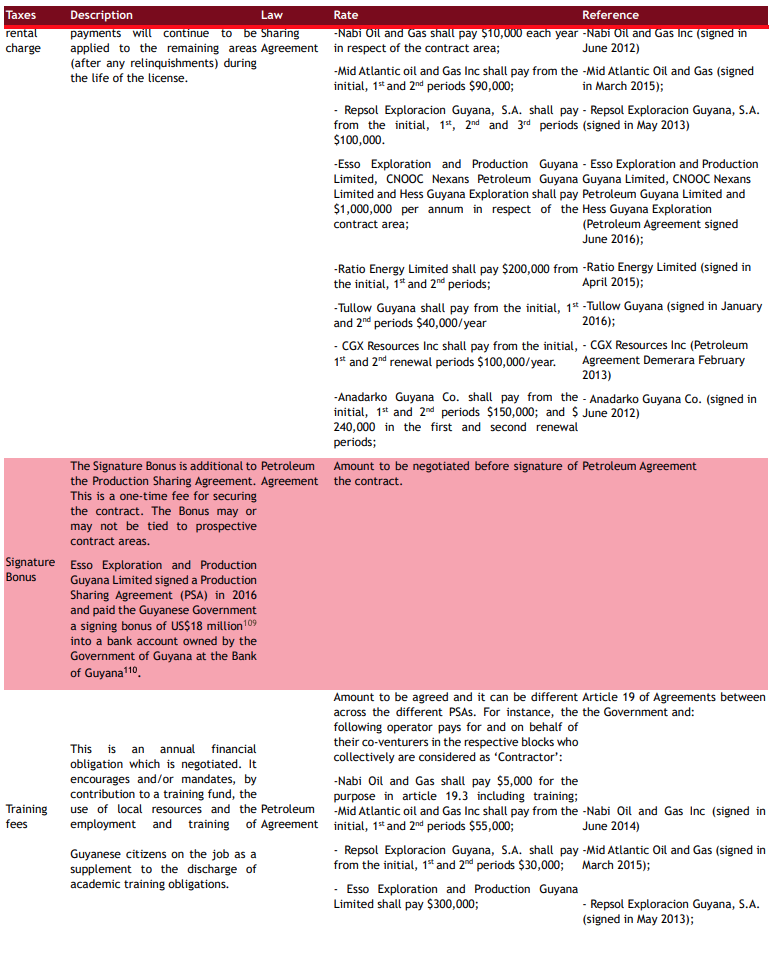

The fiscal regime of petroleum companies is set out in the Income Tax Act (Cap. 82:01) revised in 2017, the Corporation Tax Act (Cap 81:01) revised in 2018, the Property Tax Act, the Income Tax and (In Aid of Industry) Act as there are no specific legislations regarding the fiscal regime for the oil and gas sector. The main taxes applicable to the petroleum sector are listed in Section 3.2.2.(c) of the report. Section 21 of the Fiscal Enactments Act (2003)108 provides that the Minister of Finance may grant exemptions from Corporation Tax if the activity demonstrably creates new employment in Petroleum exploration, extraction, or in the refining sector.

Reforms in the oil and gas sector

Local Content Policy for the Development of Guyana’s Petroleum Economy

Since the discovery of major commercial quantities of petroleum resources in 2015, the Government of Guyana have made participation by Guyanese in the activities of the sector a priority. During the years 2017 and 2018, two drafts of a local content policy were produced on behalf of the Ministry of Natural Resources for public comment. The second policy involved extensive public consultation among the range of stakeholders across the country and industry and included an implementation strategy and the framework for an implementation plan. In 2019, the second policy was revised and expanded into a third draft, inclusive of a detailed implementation plan. The draft was further revised by a team from the Commonwealth Secretariat (CS) out of which a comprehensive report was produced for the Government of Guyana, inclusive of guidelines on its implementation and pointing towards the utility of regulations and lessons learnt in different jurisdictions, including new oil producing countries. The report was finalised and published in January 2020.115 Guyana’s Parliament enacted Local Content Act (2021) which was gazetted in August 2021. The Act seeks to mandate a gradual increase in the use of local goods and services, based on the Government’s assessment of the ability of locals to provide. The Act sets out local content levels to be met by licensed oil companies from the date their petroleum agreements or licenses become effective. In the case of sub-contractors, their contracts start from the moment they have entered into an agreement or partnership.

Petroleum Exploration and Production (Amendment) Act 2021

In August 2021, the National Assembly enacted the Petroleum Exploration and Production (Amendment) Act117 which was gazetted on 11 August 2021. The Act amended Section 52 of the Petroleum (Exploration and Production) Act, Chapter 65:04. This section deals with restrictions on rights of licensees and surface rights. It also makes amendments with regards to work done by a petroleum licensee, in aid of its operations on State land, Government land, or land otherwise controlled or under the management of the Government of Guyana.118 The explanatory memorandum of the Act states that it ensures the Government has oversight over the exercise of the licensee’s rights over private land. It states further that the amendment strengthens and protects private proprietary interests as enshrined in the Constitution of Guyana. This legal revision is being sought ahead of projects involving ExxonMobil’s local affiliate, Esso Exploration and Production Guyana Limited (EEPGL). These are the gas-to-energy projects and the laying of a fibre optic cable linking EEPGL’s onshore and offshore facilities. The laying of the fibre optic cable would provide connectivity which allows Government the means to monitor EEPGL’s offshore operations on the Liza Destiny floating production, storage and offloading vessel. The Government is looking to establish a data centre for this purpose, ensuring the prudent regulation and management of the most important current project of the oil and gas sector, Liza Phase One.

National Resource Fund NRF Act (2021)

On 30 December 2021, the National Resource Fund NRF Act (2021) was gazetted. On 30 December 2021, the National Resource Fund NRF Act (2021) was gazetted in repeal to the NRF Act 2019.

– Purpose of the NRF

The purpose of the Fund is to manage the natural resources wealth of Guyana for the present and future benefits of the people in an effective and efficient manner by-

(a) ensuring that volatility in natural resources revenues does not lead to volatile public spending;

(b) ensuring that natural resources revenues do not lead to a loss of economic competitiveness;

(c) fairly transferring natural resources wealth across generations to ensure that future generations benefit from natural resources wealth; and

(d) using natural resources wealth to finance national developing priorities including any initiative aimed at realising an inclusive green economy.

– Governance and management of the fund:

Board of Directors

The NRF Act (2021) states in Part III, section 5(1) that “there shall be a Board of Directors of the Fund which shall comprise of not less than three and not more than five members who shall be appointed by the President, one of whom shall be appointed Chairperson by the President. Responsibilities of the Board of Directors are described in section 5(5) and are :

(a) the overall management of the Fund;

(b) reviewing and approving the policies of the Fund;

(c) monitoring the performance of the Fund;

(d) ensuring compliance with the approved policies of the Fund;

(e) exercising general oversight of all aspects of the operations of the Fund; and

(f) ensuring that the Fund is managed in compliance with the 2021 NRF Act and all other applicable laws.

Public Accountability and Oversight Committee

The NRF Act (2021) states in Part III, section 6(1) that “there shall be a committee to be known as Public Accountability and Oversight Committee which should comprise the following members appointed by the President and one of whom shall be appointed Chairperson by the President.

(a) a nominee of the National Assembly;

(b) three representatives of the religious community;

(c) two representatives of the private sector;

(d) two representatives of the organised labour; and

(e) one representative of the professions.

The Committee shall provide non-governmental oversight of the Fund, and its responsibilities includes:

– receiving quarterly reports from the Board of Directors on the operations of the Fund; and

– meet no less than quarterly with the Board of Directors of the Fund to be briefed on the operations of the Fund.

Bank responsible for operational management of Fund

The NRF Act (2021) states in Part III, section 7(1) that “the Bank of Guyana shall be responsible for the operational management of the Fund and shall manage the Fund in accordance with the Investment Mandate and the operational agreement.

Investment Committee

The NRF Act (2021) states in Part III, section 8(1) that “there is established a committee to be known as the Investment Committee which should consist of the following seven members appointed by the Minister:

(a) a nominee of the Minister who shall be the Chairperson of the Committee;

(b) a nominee of the Minister responsible for the administration of the petroleum sector;

(c) a nominee of the Attorney General;

(d) a nominee of the Leader of the Opposition;

(e) a nominee of the private sector; and

(f) two ex officio non-voting members as follows:

(i) the Senior Investment Adviser and Analyst;

(ii) a nominee of the Governor of the Bank of Guyana.

The Investment Committee shall be responsible for advising the Board of Directors on the Investment Mandate, and in doing so, shall take account of

(a) the overall objectives of the Fund as outlined in the Act;

(b) the current conditions, opportunities and constraints in relevant financial markets;

(c) the need to ensure sufficient funds are available for withdrawals from the Fund;

(d) International best practices in Investment portfolio management;

(e) the principle of financial diversification with the objective of maximising risk-adjusted financial returns and considering the capacity of the institutions involved in the management of the Fund and Guyana’s ability to bear financial risk;

(f) the need for the Fund, in the long term, to achieve on average over a number of years a real total return of at least three percent per annum, in United States Dollars, while minimising risk;

(g) the need for the Fund to follow a strategic asset allocation strategy whereby over time as the balance of the Fund increases the percentage of the Fund invested in low-risk eligible asset classes decreases and the percentage of the Fund invested in higher risk eligible asset classes increases;

(h) the need for the fund to avoid tactical asset allocation;

(i) the financial modelling referred to in section 11 (d);

(j) the fees charged by the Bank as operational manager of the Fund;

(k) the fees charged by private managers; and

(l) any other relevant information.

• Deposits and withdrawals: Deposits into Fund are described in section (15) of the 2021 Act and withdrawals from the Fund in sections (16) and (17).

• Eligible Investments: Eligible investments are described in part V of the 2021 Act and are covered by sections (22) to (27).