Revenue Flows

Direct Payments

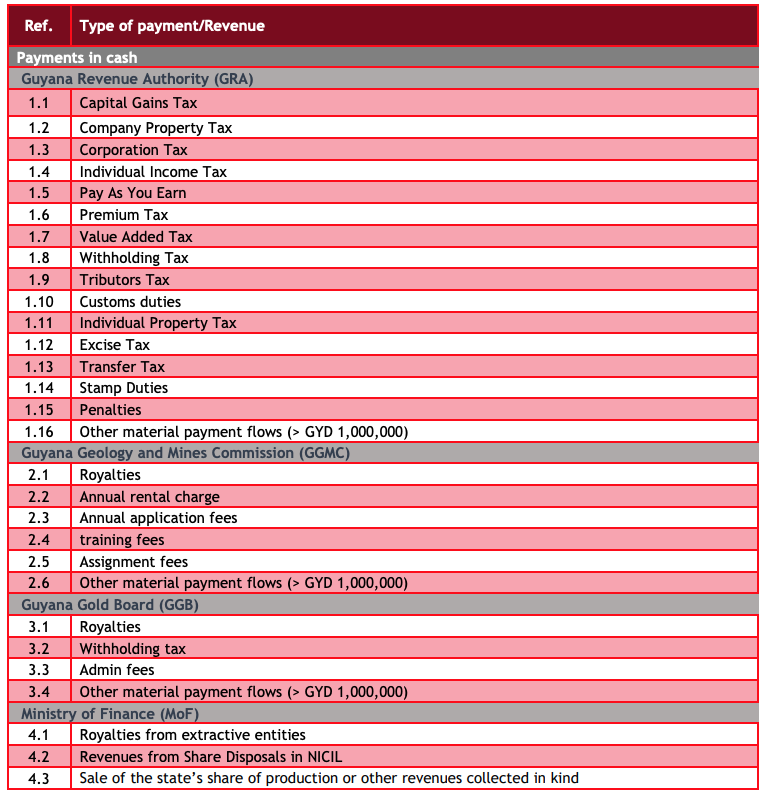

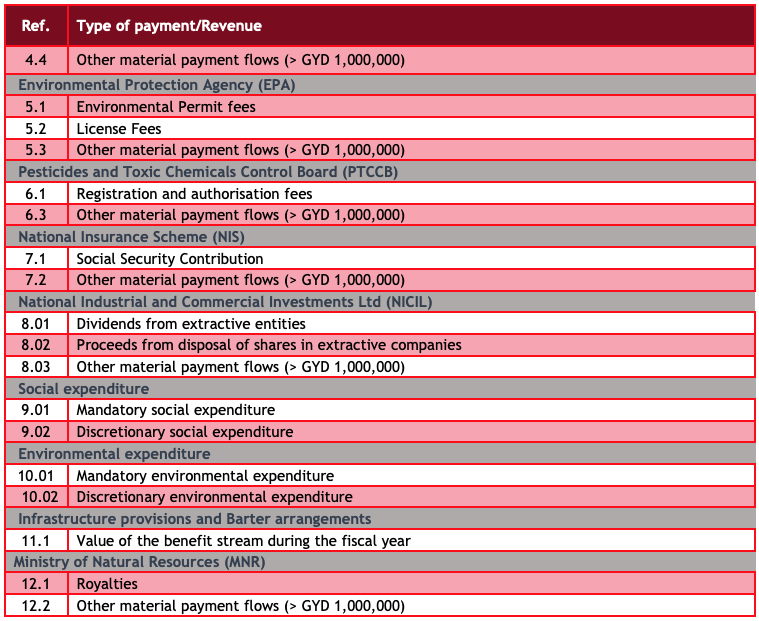

During the scoping phase, Government Agencies that received payment flows from the extractive sectors were consulted. The GYEITI MSG agreed to include in the reconciliation scope the following payment flows without applying any materiality threshold:

For revenue streams relevant to the forestry and fisheries sectors as well revenue streams relevant to the mining, oil and gas and which fell below the materiality threshold, the GYEITI MSG agreed to include the aggregated benefit streams through unilateral disclosure by Government Agencies in accordance with EITI Requirement 4.1.b.

Social and environmental expenditure

Social expenditure consists of all contributions made by extractive entities to promote local development and to finance social projects in line with EITI Requirement 6.1. This Requirement encourages the multi-stakeholder groups to apply a high standard of transparency to social payments and transfers, the parties involved in the transactions and the materiality of these payments and transfers to other benefit streams, including the recognition that these payments may be reported even though it is not possible to reconcile them. These contributions can be voluntary or mandatory and can be made in cash or in kind, depending on individual contracts. This category includes, inter alia, infrastructures in health, education, road and market gardening projects related to the promotion of agriculture as well as grants provided to the population. Requirement 6.1 states that: ‘Where material payments by companies to the government related to the environment are mandated by law, regulation or contract that governs the extractive investment, such payments must be disclosed.’ The GYEITI MSG agreed to include mandatory and discretionary social and environmental expenditure in the scope through unilateral disclosure without applying any materiality threshold.

State’s share of production and other in-kind revenues

The EITI Standard states that: ‘Where the sale of the state’s share of production of oil, gas and/or mineral resources or other revenues collected in kind is material, the government, including stateowned enterprises, are required to disclose the volumes received and sold by the state (or third parties appointed by the state to sell on their behalf), the revenues received from the sale, and the revenues transferred to the state from the proceeds of oil, gas and minerals sold. Where applicable, this should include payments (in cash or in kind) related to swap agreements and resource-backed loans. The published data must be disaggregated by individual buying company and to levels commensurate with the reporting of other payments and revenue streams (4.7). Multi-stakeholder groups, in consultation with buying companies, are expected to consider whether disclosures should be broken down by individual sale, type of product and price. The disclosures could include ownership of the product sold and the nature of the contract (e.g. spot or term).’ The MSG agreed that information on the state’s share of production of mineral resources or other revenues collected in kind during the fiscal year 2020 are included through unilateral disclosure by Government Agencies. Based on information made available, the Government Agencies have confirmed that no payments in kind from extractive entities had been received during the fiscal year 2020. None of the reporting entities declared payments in kind during the fiscal year 2020.

Subnational payments

The EITI Standard states that: ‘It is required that the multi-stakeholder group establishes whether direct payments, within the scope of the agreed benefit streams, from companies to subnational government entities are material. Where material, the multi-stakeholder group is required to ensure that company payments to subnational government entities and the receipt of these payments are disclosed.’ The GYEITI MSG decided to include subnational payments through unilateral disclosure by companies. None of the reporting entities reported subnational payments during the fiscal year 2020.

Subnational transfers

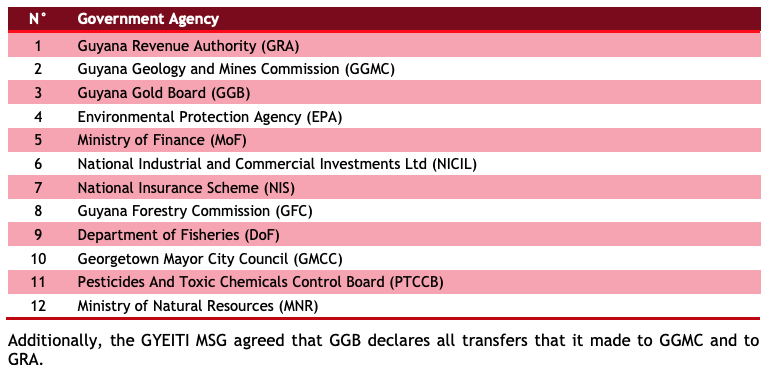

The EITI Standard states that: ‘Where transfers between national and subnational government entities are related to revenues generated by the extractive industries and are mandated by a national constitution, statute or other revenue sharing mechanism, the multi-stakeholder group is required to ensure that material transfers are disclosed. Implementing countries should disclose the revenue sharing formula, if any, as well as any discrepancies between the transfer amount calculated in accordance with the relevant revenue sharing formula and the actual amount that was transferred between the central government and each relevant subnational entity. The MSG agreed that transfers from GGMC to the Amerindian Development Fund are disclosed by the GGMC and by the Ministry of Amerindian Affairs. However, none of the government agencies confirmed any amounts transferred to Ministry of Amerindian Affairs. The MSG agreed to include in the reporting process transfers made by GGB to GGMC and to GRA.

Quasi-fiscal expenditure

EITI Requirement 6.2 states that: “Where state participation in the extractive industries gives rise to material revenue payments, implementing countries must include disclosures from SOEs on their quasi-fiscal expenditure. The multi-stakeholder group is required to develop a reporting process with a view to achieving a level of transparency commensurate with other payments and revenue streams and should include SOE subsidiaries and joint ventures. Quasi-fiscal expenditures include arrangements whereby SOEs undertake public social expenditure such as payments for social services, public infrastructure, fuel subsidies and national debt servicing, etc. outside of the national budgetary process. Implementing countries and multi-stakeholder groups may wish to take the IMF’s definition of quasi-fiscal expenditures into account when considering whether expenditure is considered to be quasi-fiscal.” The GYEITI MSG agreed to include information on the quasi-fiscal expenditure during the fiscal year 2019 through unilateral disclosure by National Industrial and Commercial Investments Ltd (NICIL), the wholly owned government company. The GYEITI MSG agreed that Information on quasi-fiscal expenditure should include arrangements whereby NICIL undertake public social expenditure such as payments for social services, public infrastructure, fuel subsidies and national debt servicing, etc. outside of the national budgetary process.

Other significant payments

EITI Requirement 4.1.c states that “any revenue streams or benefits should only be excluded where they are not applicable or where the multi-stakeholder group agrees that their omission will not materially affect the comprehensiveness of the government and company disclosures.” In order to avoid any omissions of payment flows that may be significant, the GYEITI MSG decided to include a separate line entitled “Other significant payments flows” in the reporting template for extractive companies to report any significant payments exceeding GYD 1,000,000. This may include any payment flow which is not shown in the reporting templates.

Level of disaggregation

MSG agreed on the level of disaggregation by company for the EITI data by extractive entity selected in the scope and to present aggregated revenues collected from extractive entities that are not selected in the reconciliation scope.

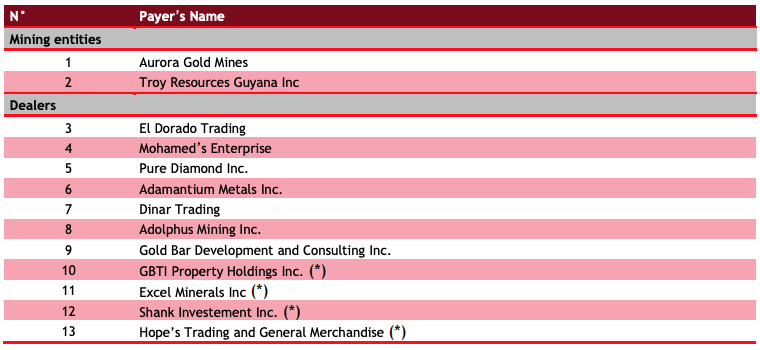

Mining companies

During the scoping process, the GYEITI MSG decided to include disaggregated revenues of thirteen (13) selected entities operating in the mining and which are eventually making material contribution to Government’s revenues. These operators are listed as follows:

(*) During the scoping phase, all dealers with active license as well as dealers from prior year EITI reports have been included in the reconciliation scope. However, four (4) dealers appeared to be non-operational during the fiscal year 2020 as formally confirmed by GGB. So, these have been subsequently excluded from the reconciliation scope.

– The state-owned enterprises:

The National Industrial and Commercial Investments Ltd (NICIL) holds participation in two (2) Bauxite companies on behalf of Government and GGB is engaged in purchasing all gold in Guyana and trade outside Guyana on behalf of Government.

Both GGB and NICIL collect revenues from companies operating in the mining sector and make transfers to other government agencies. GGB deducts royalties and taxes from gold prices following direct purchases from miners and dealers. It subsequently transfers the royalties and taxes to GGMC and GRA respectively. NICIL holds shares in the mining companies and collects dividends.

The MSG agreed including NICIL and GGB in the 2020 GYEITI reporting scope as SOEs that transfer funds collected from extractive sectors to other Government Agencies. However, NICIL confirmed that it did not collect any dividends from mining companies during 2020.

As for the remaining mining operators, which have not been selected, the MSG agreed disclosing the corresponding aggregated revenues through unilateral disclosure by Government Agencies in accordance with EITI Requirement 4.1.d. The list of mining entities retained for unilateral disclosure from Government Agencies can be found in Annex 3 to this report.

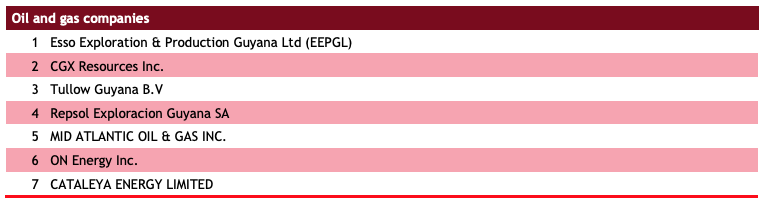

Oil and gas companies

The GYEITI MSG agreed to include all petroleum companies holding active licenses in the fiscal year 2020 in the reconciliation scope as follows:

Forestry companies

Although disclosure for this sector is not mandatory by the EITI Standard, GYEITI MSG agreed to include the forestry sector in the scope of the third GYEITI report through unilateral disclosure by Government Agencies. The Forestry sector was likewise included in the first and second GYEITI reports.

Fisheries companies

Given that disclosure for this sector is not mandatory by the EITI Standard, the GYEITI MSG agreed to include the fisheries sector in the scope of the third GYEITI report through unilateral disclosure by Government agencies. The Fisheries sector was likewise included in the first and second GYEITI reports.

Government Agencies

Based on the above proposed scope, the Government Agencies that were required to submit reporting templates are as follows:

Revenues collected from in-scope companies

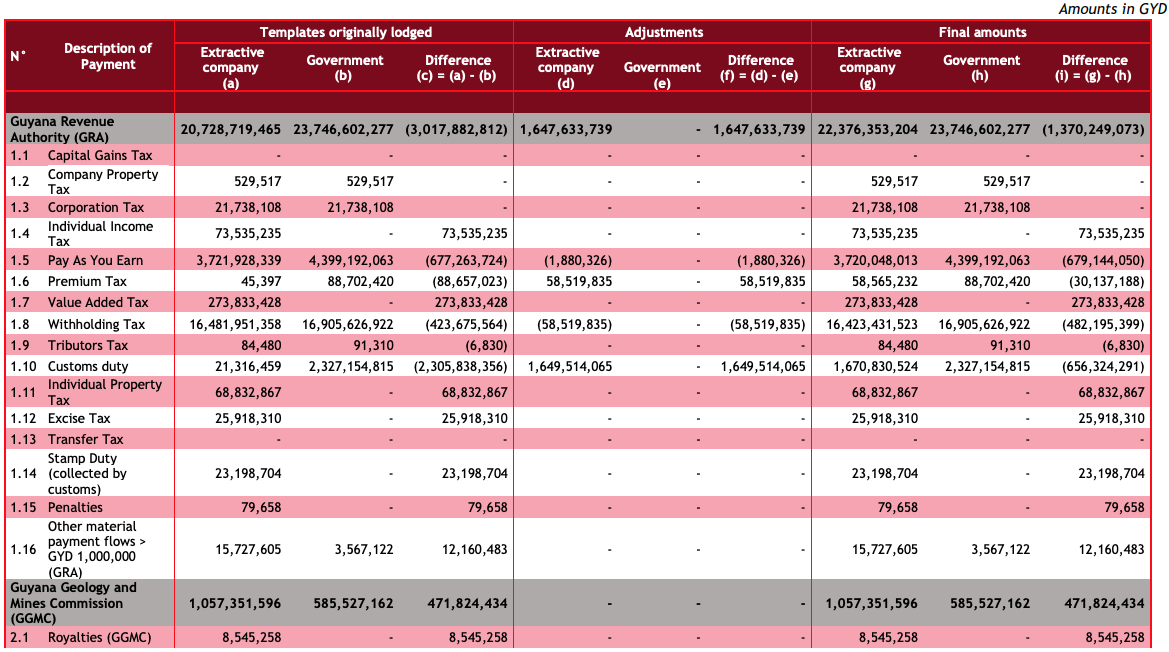

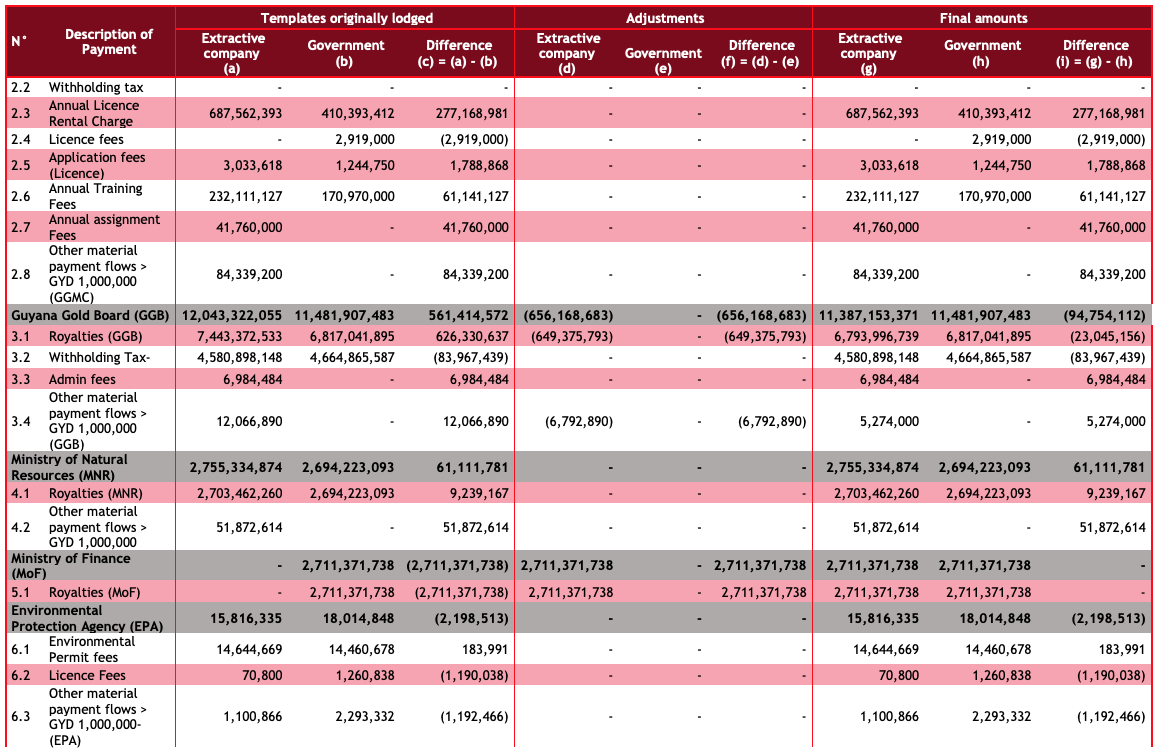

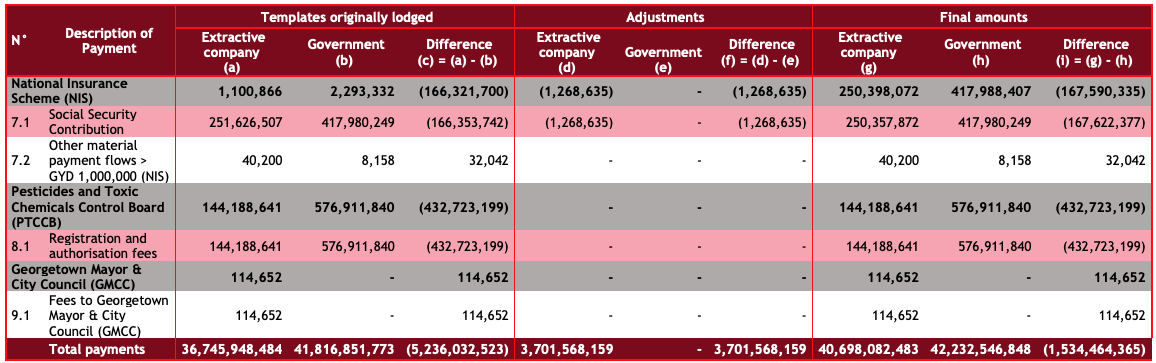

Detailed results of the reconciliation exercise, as well as differences noted between amounts paid by oil and gas companies and received by Government agencies are set out below. The tables below highlight the amounts initially reported and the adjustments made following the reconciliation work, as well as the final amounts and unreconciled differences.

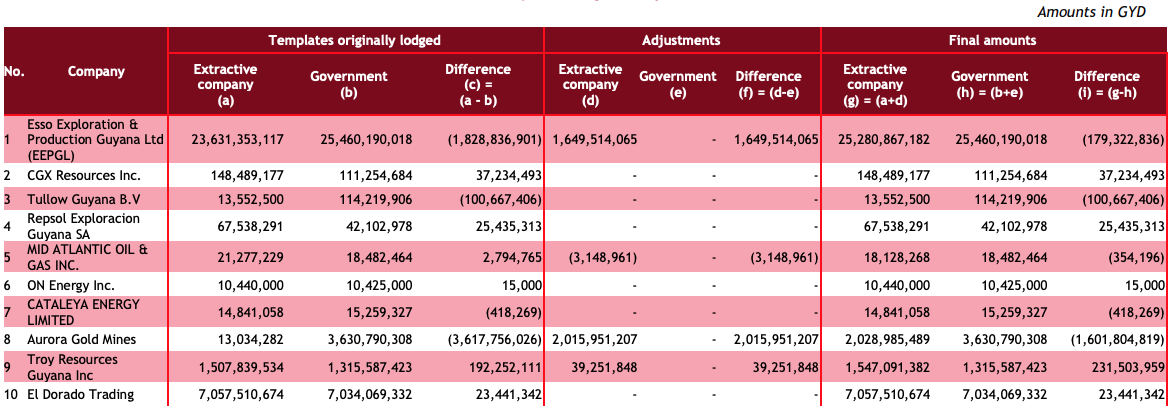

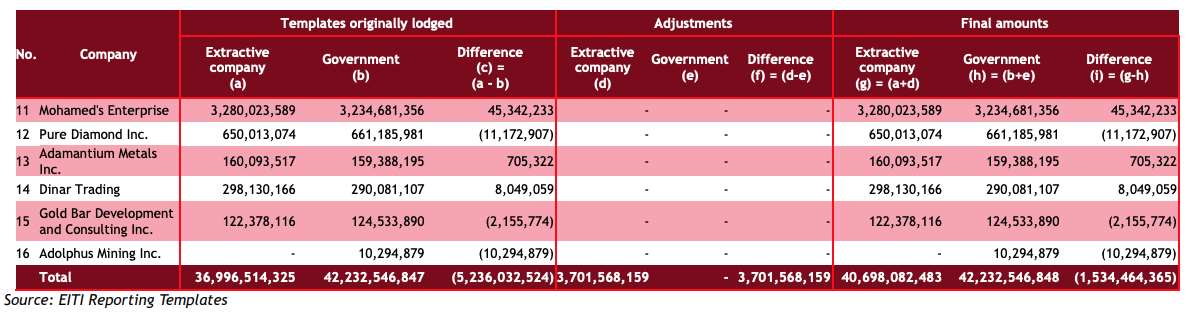

Reconciliation by Company

The table below summarises the differences between the payments reported by extractive entities and receipts reported by Government Agencies. It includes consolidated figures based on the reporting templates prepared by each company and Government Agency, adjustments made by us following our reconciliation work and the residual, unreconciled differences. Details of the adjustments are presented in Section 5.1.2 of this report and to keep the report size reasonable, detailed reconciliation sheets for each company are included in Annex 9 to this report.

Reconciliation by revenue stream

The table below shows the total initial payments reported by extractive entities and Government Agencies, after adjustments:

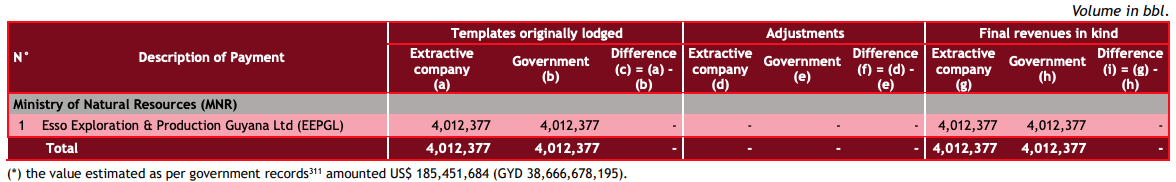

Reconciliation of revenues in kind

The table below summarises the reconciliation of the in-kind payments in Bbl of oil reported by EEPGL and receipts reported by the Ministry of Natural Resources (MNR). The reconciliation results are detailed as follows:

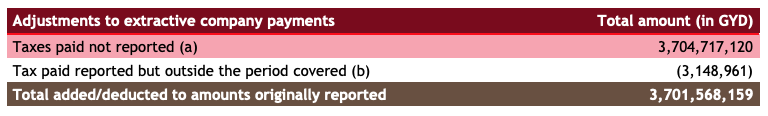

Adjustments to extractive entities’ payments

The adjustments were carried out following confirmations received from extractive entities and Government Agencies and were supported by adequate evidence wherever deemed appropriate. The adjustments made are as follows:

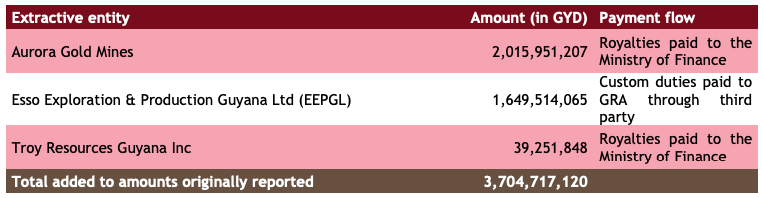

(a) Taxes paid not reported These are payment flows reported by Government Agencies but not reported by Extractive entities. Adjustments were made to the figures reported by companies on the basis of flag receipts by Government Agencies. A summary of the adjustments made to companies’ disclosure is set out in the table below:

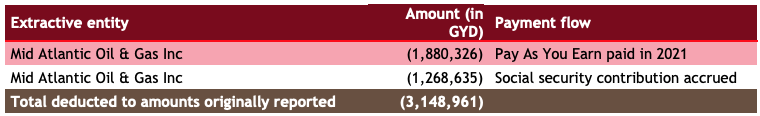

(b) Tax paid reported but outside the period covered These relate to taxes paid by companies to Government Agencies outside the period covered by the reconciliation. Details of the adjustments made to company payments are set out in the table below: